'Edit Transaction Templates' screen

The ‘Edit Transaction Template’ screen allows you to make edits to a transaction and create new transactions. You can make edits to either ‘Transaction Template Details’ or ‘Cash Flows .’ Click on any segment (In Blue) to make changes within each Transaction category.

General Info

The General Info section is where you define the basic characteristics of the transaction to include the Transaction name, Description, Display Name(the name used in your proposal), the Transaction Term in years (defines the term on cash flow statements), and the status (Active or Archived). A transaction needs to be “Active” to be displayed under the suggested transaction list when building a proposal.

Electric Bill Savings

For your Electric Bill savings, you will specify if the transaction will include electric bill savings from PV and ESS in the cash flow analysis and if the transaction will make changes on the State or Federal Levels.

Custom Reference Variable

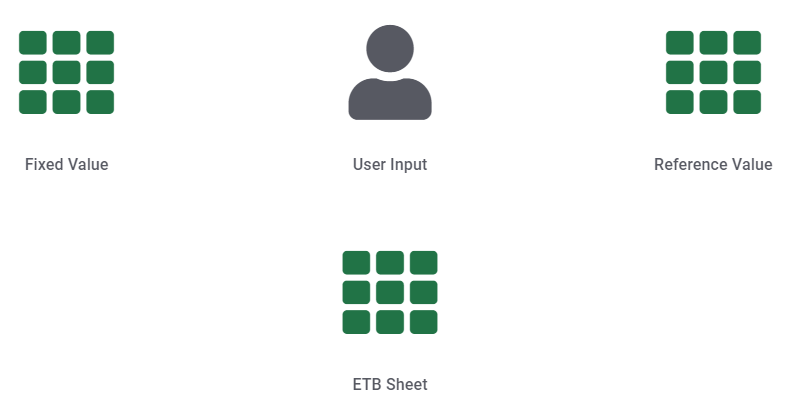

Energy Toolbase allows you to create custom reference variables that you can use within a financial model or calculation to output a specific result. To make a reference variable, you first need to click on the 'Add Custom Reference Variables' and then choose one of 4 options; Fixed Value, User Input, Reference Value, ETB Sheet.

Input Type: The 'Input Type' is an important distinction and something that anyone creating or making edits to a Transaction Template needs to understand well. The difference is basically deciding when an input (i.e., transaction term in years) for a given Transaction gets specified.

- Fixed Input: an input that an account administrator pre-specified for a given transaction.

- User Input: an input that the user will be required to specify.

Fixed Value is a variable that holds a static value and will not change. You will be asked to give it a Name and its Value which can be used for calculations in the transaction.

User Input: This is a versatile option that allows you to create a blank variable that will prompt a user to enter its value each time the transaction template is utilized. This option is perfect for Operation and Maintenance costs, Interest rates, or other values which change from project to project.

Reference Value: presents the option to choose a specific variable from a list which will then automatically pull information from a project for that value type. An example of this is “Total Project Cost.” If a user were to select this option and place it within a calculation, it will pull whatever the total project cost is in that proposal and use that value in the calculation. You also can select any custom reference variables you have created and add them into a calculation.

ETB Sheets: This option will function very similarly to Excel and allows you to input reference variables and perform simple or complex calculations.

Tables Used in Proposal Documents

This is where you specify the values that are displayed in the Proposal Document Summary Table and can be added or removed to customize the information presented in the document.

Cash Flows

Cash Flows are where you create and specify different payment types and conditions of those payments for a given transaction. You can create 1 or many ‘Payment Streams’ for a given Transaction. You also can create 1 or many ‘Conditions’ for a given ‘Payment Stream.’ From the ‘Edit Transaction Template’ screen, you can see a summary of the ‘Cash Flows’ for a given transaction. Clicking on any of the hyperlinks allows you to add or edit those ‘Cash Flow’ and ‘Payment Streams.’

A Cash Flow is the framework of a calculation applied to project analytics and shown within the Cash Flow Analysis in a Document.

Each Cash Flow will appear as its own tab in the Cash Flow portlet. Each Cash Flow will have its name, cash flow type (Income, Payment, Federal Tax Credit, etc.), and whether the cash flow contributes to the Total Payment displayed at the top.

Below those details, you will see the following:

- Payment Streams: whether the ‘Cash Flow’ is a single payment, monthly payment, annual payment, or amortization schedule. Each Series type will present you with several conditions that you can individually define.

- Amortization Schedule: A table that lists each regular payment over time. A portion of each payment would be applied to the principle and interest. Throughout the amortization, a larger percentage of the payment will shift towards the principle, and less will be applied to interest.

- Single Payment: A calculation that will occur one time for one defined year.

- Monthly Payment: An annual payment based on a Monthly Payment Amount

- Annual Payment: The total amount paid over one year, which would repeat each year.

- Equipment Replacement: This series type will reference company settings and apply replacement costs for Simple or Detailed Equipment for PV and ESS in your Cash Flow. You must define these values within their company settings.

-

Payment Amount: will reference which specific value will be used as your starting payment amount for the Series. The inputs for these references can be either Fixed Value, User Input, Reference Value, or ETB Sheet.

-

Payment Year: The year in which the calculation or reference variable will begin to influence the cashflow.

- Changes Taxable Income: whether or not the calculation will be applied to State and/or Federal Taxes. Please consult a tax professional for advice if you are unsure what to select. Selecting "False" will always be a conservative approach.

+Add Condition: where you can specify certain conditions to be met related to the ‘Cash Flow Series.’ For example, you can specify that a project is eligible for a certain incentive value “IF” the system size is “greater than or equal to” a certain value.